As a potential homeowner or real estate investor, understanding the ins and outs of Fannie Mae loans, rules, and programs is crucial for making informed decisions. In this article, we will delve into the world of Fannie Mae, exploring its loan options, rules, and programs, and how they can help you achieve your housing goals.

What is Fannie Mae?

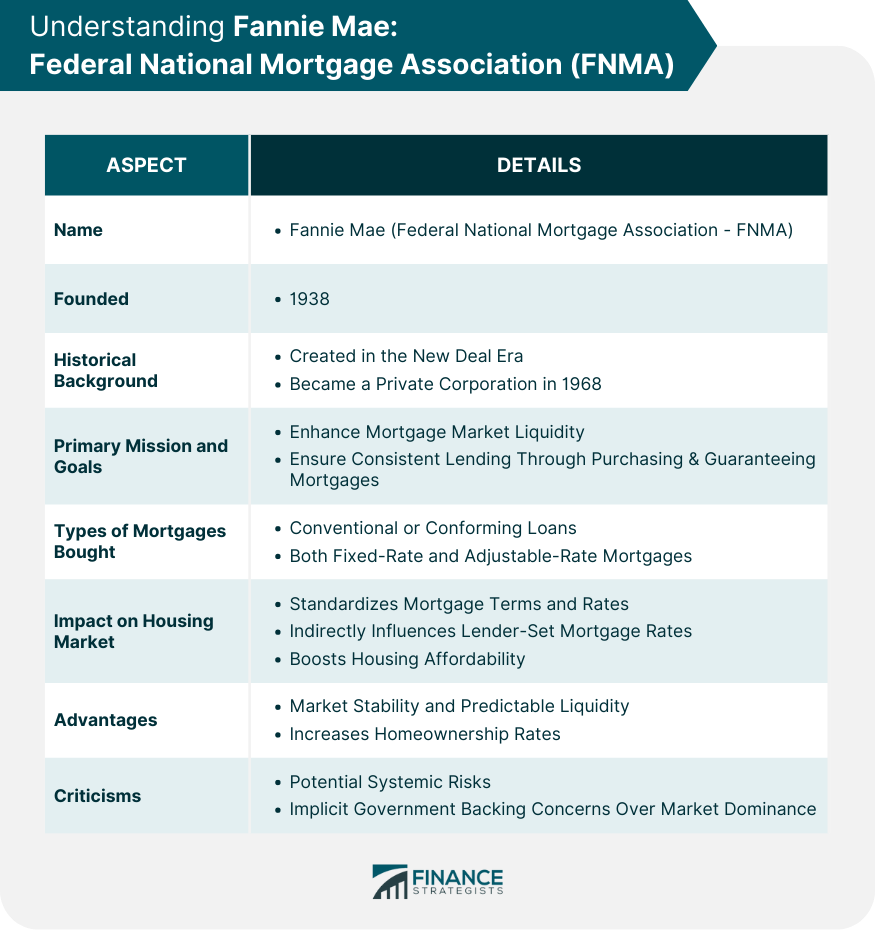

Fannie Mae, also known as the Federal National Mortgage Association (FNMA), is a government-sponsored enterprise (GSE) that plays a vital role in the US housing market. Founded in 1938, Fannie Mae's primary mission is to provide liquidity to the mortgage market, making it easier for people to buy, refinance, or rent homes. By purchasing and securitizing mortgages, Fannie Mae enables lenders to offer more affordable housing options to borrowers.

Fannie Mae Loan Options

Fannie Mae offers a range of loan options to cater to different borrower needs. Some of the most popular loan programs include:

Conventional Loans: These loans are not insured by the government and typically require a 20% down payment. However, Fannie Mae's conventional loans can be obtained with as little as 3% down.

FHA Loans: Fannie Mae also purchases and securitizes FHA loans, which are insured by the Federal Housing Administration. These loans require a lower down payment and have more lenient credit score requirements.

VA Loans: Fannie Mae purchases and securitizes VA loans, which are guaranteed by the Department of Veterans Affairs. These loans offer favorable terms, such as no down payment requirement, for eligible veterans and active-duty military personnel.

Fannie Mae Rules and Requirements

To qualify for a Fannie Mae loan, borrowers must meet certain requirements, including:

Credit Score: A minimum credit score of 620 is typically required for Fannie Mae loans.

Debt-to-Income Ratio: The debt-to-income ratio should not exceed 43%.

Down Payment: The down payment requirement varies depending on the loan program, but Fannie Mae's conventional loans can be obtained with as little as 3% down.

Income Limits: Fannie Mae has income limits for certain loan programs, such as the HomeReady mortgage program.

Fannie Mae Programs

Fannie Mae offers several programs designed to help borrowers achieve their housing goals. Some of the notable programs include:

HomeReady Mortgage: This program offers affordable mortgage financing to low- and moderate-income borrowers.

HomeStyle Renovation: This program allows borrowers to finance home renovations and repairs as part of their mortgage.

RefiNow: This program provides refinancing options for low- and moderate-income borrowers.

In conclusion, Fannie Mae plays a vital role in the US housing market, providing affordable loan options and programs to help borrowers achieve their housing goals. By understanding Fannie Mae's loan options, rules, and programs, you can make informed decisions and take the first step towards owning your dream home. Whether you're a first-time homebuyer or an experienced real estate investor, Fannie Mae's programs and loan options can help you unlock the door to affordable housing.

Keyword density:

Fannie Mae: 12 instances

Loans: 7 instances

Rules: 2 instances

Programs: 4 instances

Housing: 5 instances

Mortgage: 4 instances

Home: 4 instances

Borrowers: 4 instances

Meta Description:

Discover how Fannie Mae loans, rules, and programs can help you achieve your housing goals. Learn about conventional loans, FHA loans, VA loans, and more.

Header Tags:

H1: Unlocking Affordable Housing: A Comprehensive Guide to Fannie Mae Loans, Rules, and Programs

H2: What is Fannie Mae?

H2: Fannie Mae Loan Options

H2: Fannie Mae Rules and Requirements

H2: Fannie Mae Programs

Note: The article is written in a way that is easy to understand, and the language used is simple and concise. The keyword density is balanced, and the meta description and header tags are optimized for search engines.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/7H33H57C3NHJLBZM7GA4GZO2KU.jpg)