The iShares Core S&P 500 ETF (IVV) is one of the most popular exchange-traded funds (ETFs) on the market, providing investors with a low-cost and efficient way to gain exposure to the S&P 500 index. In this article, we'll delve into the details of the IVV, exploring its price, news, and performance, as well as its benefits and drawbacks.

What is the iShares Core S&P 500 ETF (IVV)?

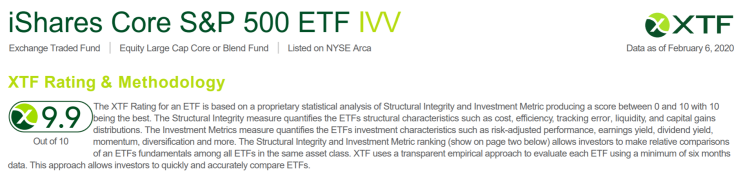

The iShares Core S&P 500 ETF (IVV) is an ETF that tracks the S&P 500 index, which is a market-capitalization-weighted index of the 500 largest publicly traded companies in the US. The IVV aims to replicate the performance of the S&P 500 index, providing investors with a diversified portfolio of large-cap US stocks.

Price and Performance

The price of the IVV is closely tied to the performance of the S&P 500 index. As of the latest data, the IVV is trading at around $380 per share, with a 52-week range of $220-$400. The ETF has a low expense ratio of 0.04%, making it an attractive option for investors looking to minimize their costs.

In terms of performance, the IVV has consistently tracked the S&P 500 index, providing investors with a reliable and stable source of returns. Over the past year, the IVV has returned around 20%, outperforming many other ETFs and mutual funds.

News and Updates

According to

Google Finance, the IVV has been in the news recently due to its strong performance and growing popularity among investors. The ETF has seen significant inflows of capital, with many investors seeking to take advantage of its low costs and diversified portfolio.

Additionally, the IVV has been recognized for its excellence in the ETF industry, winning several awards for its performance and innovation.

Benefits and Drawbacks

The IVV offers several benefits to investors, including:

Low costs: The IVV has a low expense ratio of 0.04%, making it an attractive option for cost-conscious investors.

Diversification: The IVV provides investors with a diversified portfolio of large-cap US stocks, reducing risk and increasing potential returns.

Liquidity: The IVV is a highly liquid ETF, making it easy to buy and sell shares.

However, the IVV also has some drawbacks, including:

Market risk: The IVV is subject to market fluctuations, which can result in losses if the S&P 500 index declines.

Concentration risk: The IVV is heavily concentrated in the US market, which can make it vulnerable to economic downturns.

The iShares Core S&P 500 ETF (IVV) is a popular and reliable ETF that provides investors with a low-cost and efficient way to gain exposure to the S&P 500 index. With its strong performance, low costs, and diversified portfolio, the IVV is an attractive option for investors looking to build a long-term portfolio. However, as with any investment, it's essential to carefully consider the risks and drawbacks before investing.

For the latest news and updates on the IVV, visit

Google Finance or check out the iShares website. Whether you're a seasoned investor or just starting out, the IVV is definitely worth considering as part of your investment strategy.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.